“Innovation distinguishes between a leader and a follower.”

Steve Jobs famously said this about leadership, and it applies to both individuals and companies looking to lead the pack in their respective industries.

Apple Inc. is a titan of the tech world, consistently ranking among the most valuable companies globally. Founded in 1976 by Steve Jobs and Steve Wozniak, Apple started with personal computers and revolutionized the industry with the Macintosh.

Their product portfolio has expanded to include iconic devices like the iPhone, iPad, and Apple Watch, each shaping how we interact with technology. Beyond hardware, Apple offers a robust software ecosystem (iOS, iPadOS, macOS) and popular services like iTunes, iCloud, and Apple Music. The list goes on.

Apple’s focus on innovation and user experience has garnered a fiercely loyal customer base, making Apple a profitable and highly valuable company.

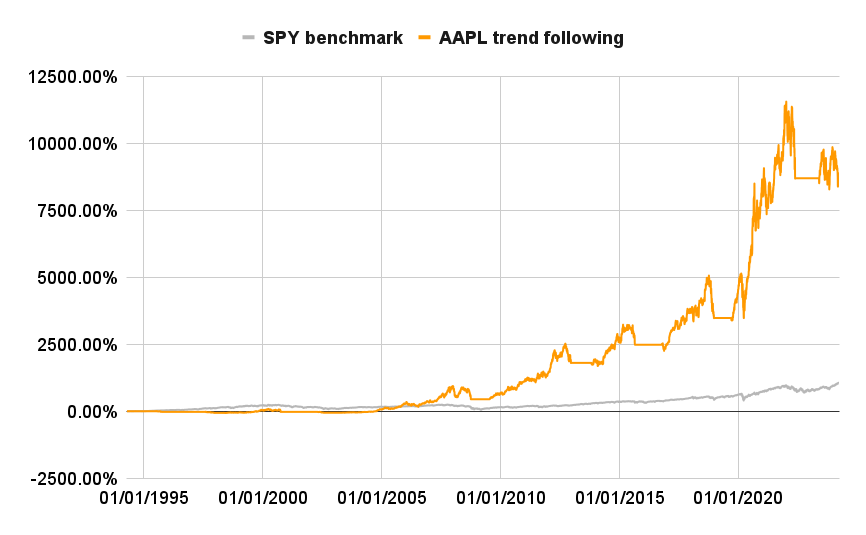

This is rightfully reflected in their share price:

Apple Inc: 3 decades of trend following

Apple stock (AAPL) is a great case study of how rule-based trend following strategies can capture outsized returns by following prevailing trends.

30-year backtest results against benchmark (SPY):

A trend following model applied on AAPL, excluding dividend gains

Here is a breakdown of the historical trend following performance of AAPL:

Lifetime return (30 years): 8,598%

Annualized return: 287%

Market exposure: 66% of the time in market

Versus SPY benchmark:

Lifetime return (30 years): 1,066%

Annualized return: 36%

You’d notice that there were periods of “flatlining” in the equity curve. These are periods where no buy positions were taken, because there weren’t justified trends at those particular moments.

There were also periods of underperformance against the SPY benchmark, where trends were not prevalent, and losses were being cut.

This is to be expected for trend following strategies - Remember the mantra: “Cut your losers short, let your winners run.”

Expect the unexpected, and be ready for it

Apple stock is just one piece of the puzzle. With diversification across asset class, geography and industry, you can build a resilient, all-weather trend following portfolio that beats the market.

As Steve Jobs aptly put it, “You can't connect the dots looking forward; you can only connect them looking backwards.” This emphasizes the importance of a long-term perspective in investing.

Past performance isn't a guarantee, but successful companies often focus on innovation and building something valuable over time. When they do, as investors, we want to be in the market when that value is baked into the share price.

That is the trend following way.