Here’s a perennial problem in investing:

Should you dollar cost average, or adopt lump sum investing?

Lump sum investing vs dollar cost averaging

First and foremost, let’s get our definitions straight:

Lump sum (LS): Investing your money all at once

Dollar cost averaging (DCA): Investing your money over time. For example, splitting your money into equal tranches and putting them into an asset over a fixed time interval (E.g. Once every month)

There is a significant amount of literature written on this topic, and the numbers tell us that DCA tends to underperform.

The only times when DCA beats LS is when the market crashes (1974, 2000, 2008, etc).

This is because DCA buys into a falling market, and gets a lower average price than a lump sum investment would.

Is that the full story though?

Return vs drawdown comparison

I thought it would be interesting to do a side-by-side comparison of DCA vs LS investing, and to take a closer look at the average returns and maximum drawdowns.

This would give us a clearer picture of both sides of the coin: Return vs risk.

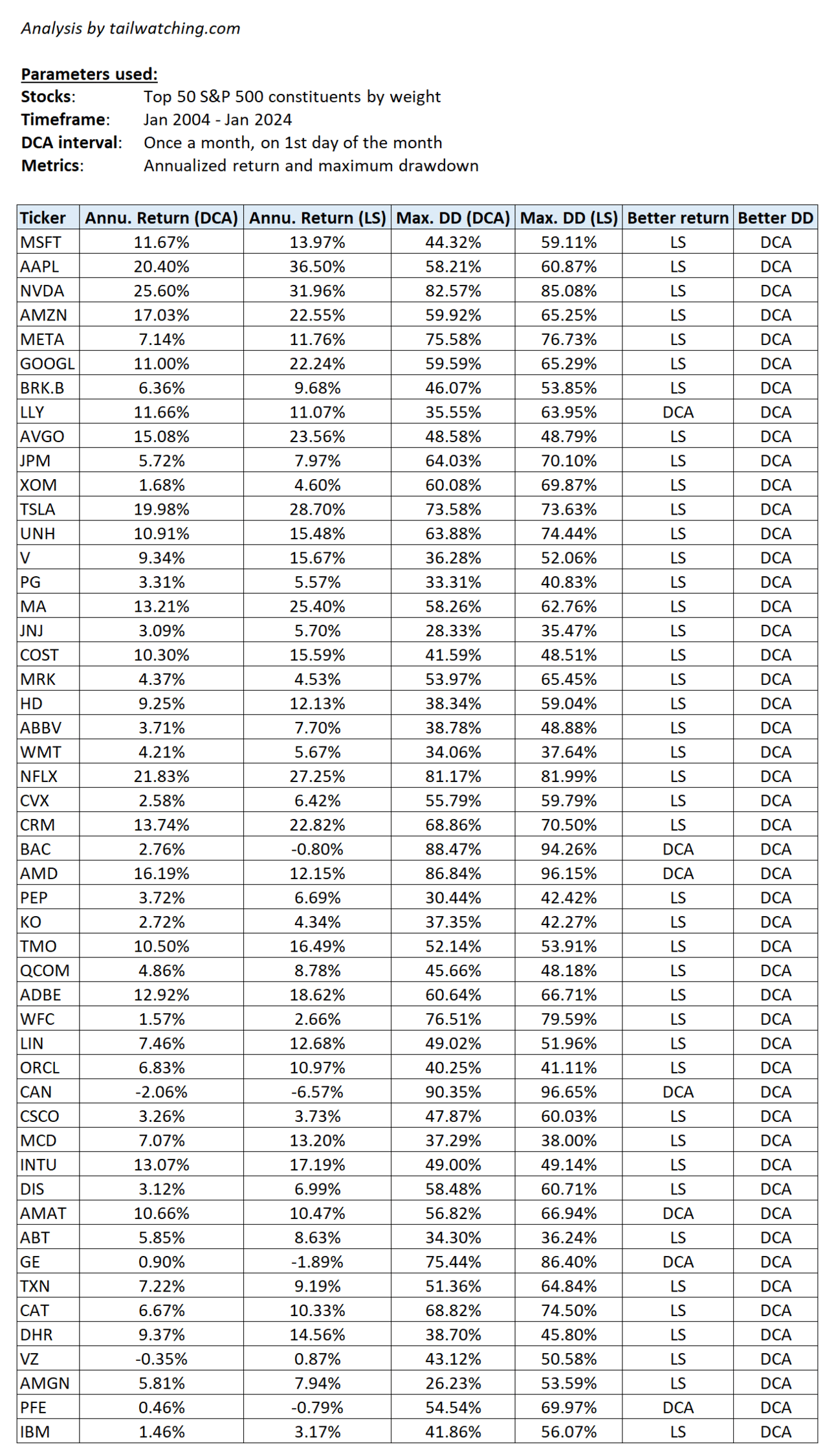

Here are the parameters used in this analysis:

Stocks: Top 50 S&P 500 constituents by weight

Timeframe: Jan 2004 - Jan 2024

DCA interval: Once a month, on 1st day of the month

Metrics: Annualized return and maximum drawdown

From this analysis, it is clear that DCA underperforms LS, but has on average, lower drawdowns.

This would bode well for investors who can accept slightly lower returns in exchange for lower volatility in their portfolios.

Is DCA for you?

The reality for most retail investors is that money comes in intervals, through salaries and bonuses.

This means that DCA would be an easier approach for many to get started with investing.

We have also seen the evidence of how DCA lowers your average drawdown, despite bringing in lower average returns.

As a retail investor who does not try to optimize timing the market, DCA can be a good solution.

That’s it for today!

Got questions? Feel free to drop me a note. I respond to every email.

I’ll see you soon!