The extreme weakening of the Japanese Yen over the past 2 years has prompted analysts to repeatedly mention the term “carry” trading.

What exactly is a carry trade?

Let’s find out!

What is a carry trade?

A carry trade is the use of one financial asset to fund the purchase of another financial instrument. The profit comes from the difference in the interest rates.

This is an investment strategy that is most often associated with currency trading. In effect, an investor borrows money in one currency with a low interest rate, and invests in a currency with a higher interest rate.

Naturally, currency pairings with high interest rate spreads are preferred, such as USDJPY, AUDJPY, NZDJPY.

(Yes, the Japanese Yen is an all-time favourite)

Case study: AUDJPY and NZDJPY

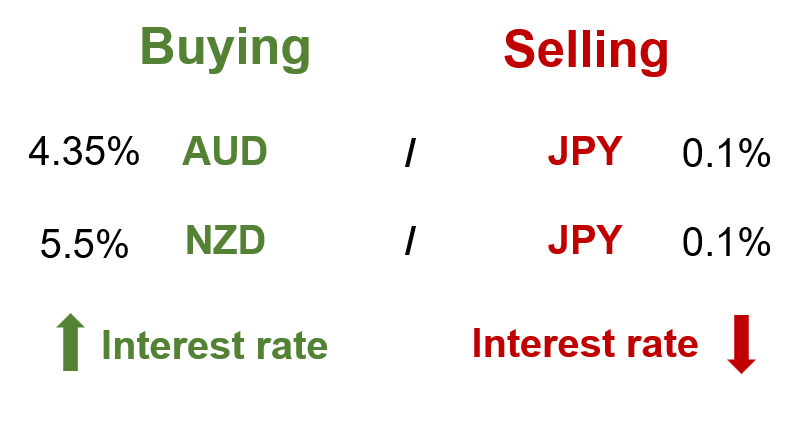

Here’s an example of borrowing in Japanese Yen to invest in Australian or New Zealand dollars:

From the image above, you can see that both AUD and NZD have higher interest rates than JPY. If you were to buy AUDJPY, you would earn the interest rate difference of 4.25%. If you were to buy NZDJPY, you would earn the interest rate difference of 5.4%.

The reverse is true if you were to sell AUDJPY or NZDJPY instead of buying. This is also known as “negative carry” trades, where the cost of holding your investment exceeds the income received from it.

What’s the catch?

As with all investment strategies, there are always risks involved.

If you are a carry trader, these are the risk factors that you have to take note of:

Interest rates are not static. In the event that they move, especially after monetary policy announcements, it is possible for a trend to shift

The price movements of currency pairs can be volatile. Negative capital losses from price movements may negate your interest earnings

Are you ready to be a carry trader?

Carry trading can be a lucrative strategy, but it’s essential to approach it with caution.

While the potential for profit is enticing, remember that economic and political factors can significantly impact interest rates.

To succeed in carry trading, rigorous risk management is paramount.

Carefully monitor your positions and be prepared to adjust your strategy as market conditions evolve.

Ultimately, the decision to become a carry trader should be based on a thorough understanding of the risks involved and well-defined long term investment plan.

Good luck!

That’s it for today!

Got questions? Feel free to drop me a note. I respond to every email.

I’ll see you soon!