Ask Warren Buffett about Tesla (TSLA) stock and he’d tell you to stay away from it.

TSLA is by no means an undervalued stock.

In fact, it’s way overvalued, according to fundamental valuation methods.

But as a Tail Watcher, I can’t ignore the fact that TSLA responds extremely well to trends.

That is what makes this ticker so intriguing, because of how polarizing it is.

Let’s break this down.

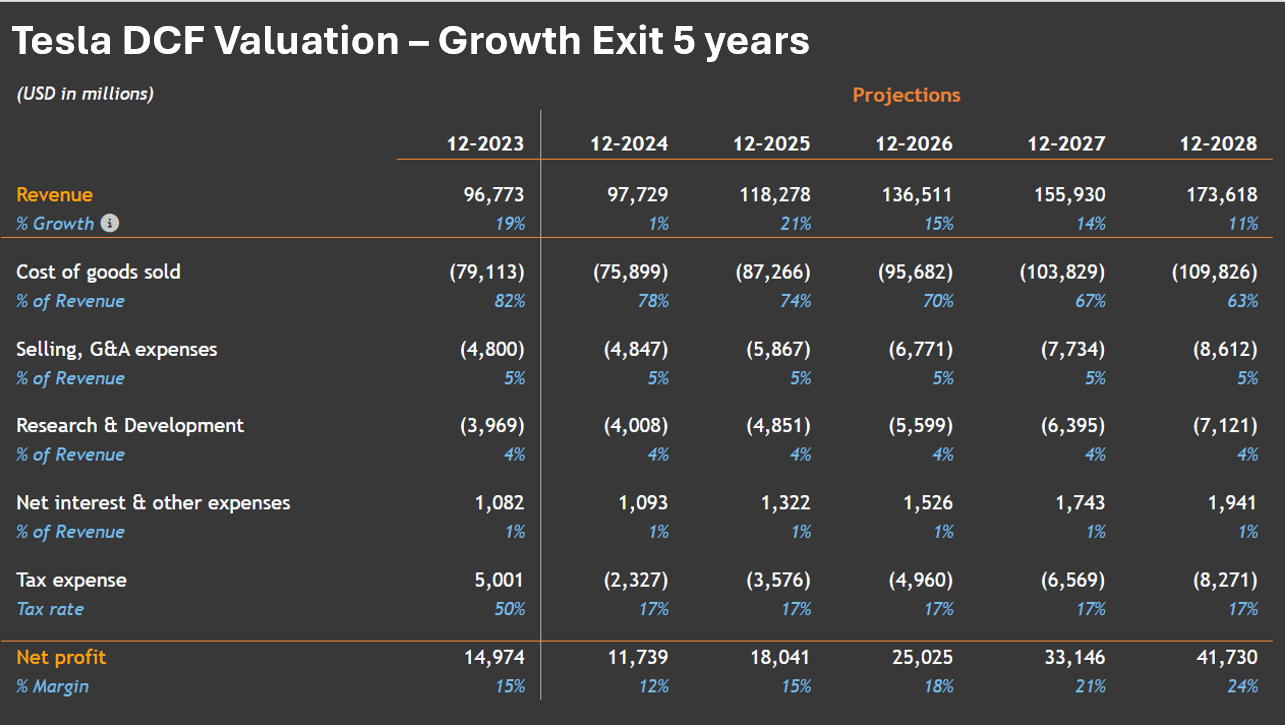

Discounted cash flow (DCF) analysis of TSLA

Let’s wear the hat of a fundamental analyst, and evaluate TSLA as a value investor would.

The valuation method I’ll use is the DCF method, which incorporates the time value of money, and utilizes future cash flows, discounted using the weighted average cost of capital (WACC) to give their present values.

This provides us with an intrinsic value (i.e. A perceived fair value) of TSLA.

For the purposes of this analysis, we’ll break down the numbers for the following:

DCF growth exit 5 years

DCF growth exit 10 years

Note: The analysis was performed on the 1st week of Nov, 2024.

1. DCF growth exit 5 years

Projected upside of TSLA (DCF with growth exit of 5 years)

5-year DCF projection of TSLA’s topline

A -32% upside isn’t exactly a value investor’s dream.

(As of writing, TSLA has reached $339.64, representing a -40.7% upside)

In fact, it screams “Stay away!”

Let’s stretch the terminal value to a 10-year horizon and see if it’s any better:

2. DCF growth exit 10 years

Projected upside of TSLA (DCF with growth exit of 10 years)

10-year DCF projection of TSLA’s topline

(As of writing, TSLA has reached $339.64, representing only a 2.31% upside).

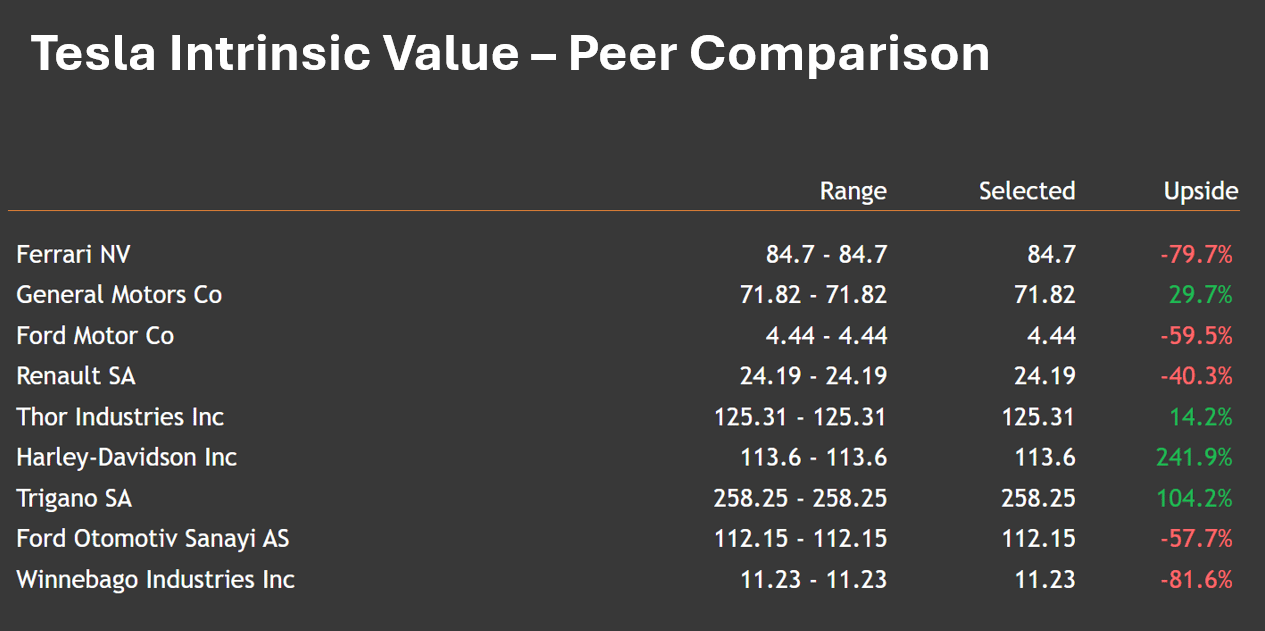

To make it even more comprehensive, let’s look at the valuation summary and peer comparison:

Valuation summary for TSLA

5-year DCF peer comparison

As you can tell, TSLA isn’t exactly the best stock to hold for a value investor.

What does the Tail Watching model tell us?

TSLA, has without a doubt, made huge leaps in capital gains, making it a great example for trend following.

This is how TSLA responds to different lookback periods of the Tail Watching model:

TSLA’s response to different lookback periods over the last 11 years

Generally speaking, TSLA responds well to trend following, and especially so for smaller lookback periods, with average holding periods of 20 days.

Here’s a breakdown of the historical performance of TSLA using the Tail Watching model:

Tail Watching (TSLA) performance: 10-yr CAGR

Tail Watching (TSLA) performance: 5-yr CAGR

Tail Watching (TSLA) performance: 1-yr CAGR

Not bad at all!

One man’s trash is another man’s treasure

TSLA is a great example of how an overpriced stock with out of whack financial ratios could still function as a strong performer in a trend follower’s portfolio.

Different schools of thought chasing the same outcome - Profits.

I hope my analysis provides you with a fresh perspective of how you could profile a stock in a different way, and look at valuating a business using systematic benchmarks from a Tail Watcher’s perspective.

That’s it for today!

Got questions? Feel free to drop me a note. I respond to every email.

I’ll see you soon!