Are you overwhelmed by the stock market?

“What if I have timed my entries wrongly?”

“What if I could have entered at a better price?”

“What if the stock price dips right after I make the purchase?”

Sounds familiar? You are not alone.

Picking individual stocks can be like navigating a jungle - exciting, but full of hidden dangers.

Life is busy enough. We could all use a simpler way to approach investing.

This is where systematic investing comes in.

Meet your rule-based, emotionless co-pilot

Systematic investing is an approach that emphasizes rule-based systems with clearly predefined and repeatable steps. For example:

The hallmarks of a systematic strategy are as follows:

Rules are predefined and require no discretionary decision-making

Rules can be backtested to analyze past performance

Here is an example of a systematic trend following strategy applied to Microsoft (MSFT):

Entry: Enter a buy position if price has been trending for the last 2 quarters

Exit: Exit buy position if price has stopped trending

30-year backtest results against benchmark (SPY):

A trend following model applied on MSFT, excluding dividend gains

Because the rules are predefined and can be backtested, if provides me with the confidence to follow these rules with conviction. There is no need for occasional interventions as long as I follow the rules.

That’s the beauty of systematic investing.

The 2 types of systematic strategies

Semantics aside, there are really just 2 broad groups of systematic investing strategies:

Convergent strategies (where prices converge towards a certain point)

Divergent strategies (where prices diverge from a certain point)

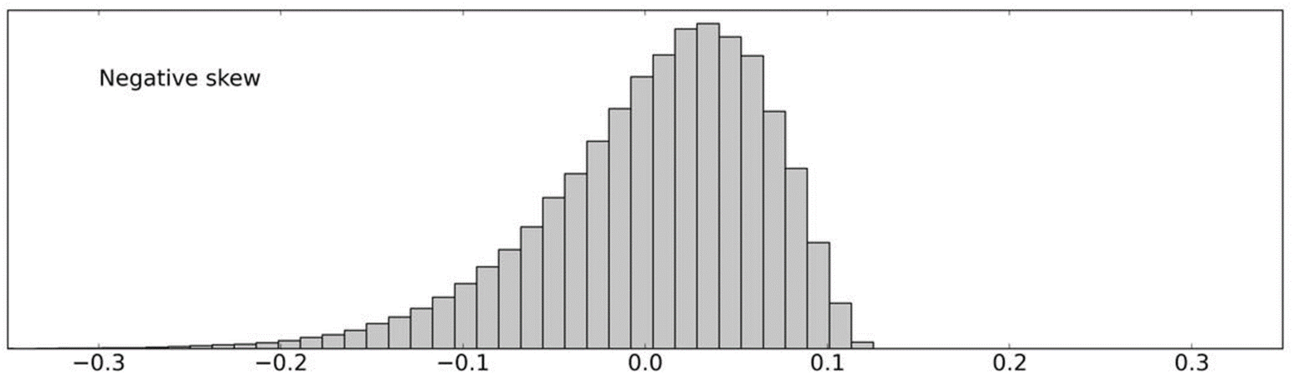

Convergent strategies

Convergent strategies, such as mean reversion strategies, assume that asset prices have deviated from an “equilibrium” price and would eventually revert to its equilibrium.The returns of a convergent strategy follow a left-skewed distribution:

Return distribution of a convergent strategy (Y-axis: Frequency, X-axis: % return)

Profile of a convergent strategy:

High win rate (E.g. 70% of positions are profitable)

Avg. gain per trade < avg. loss per trade

TLDR: More winning trades than losing trades, but average losses are higher

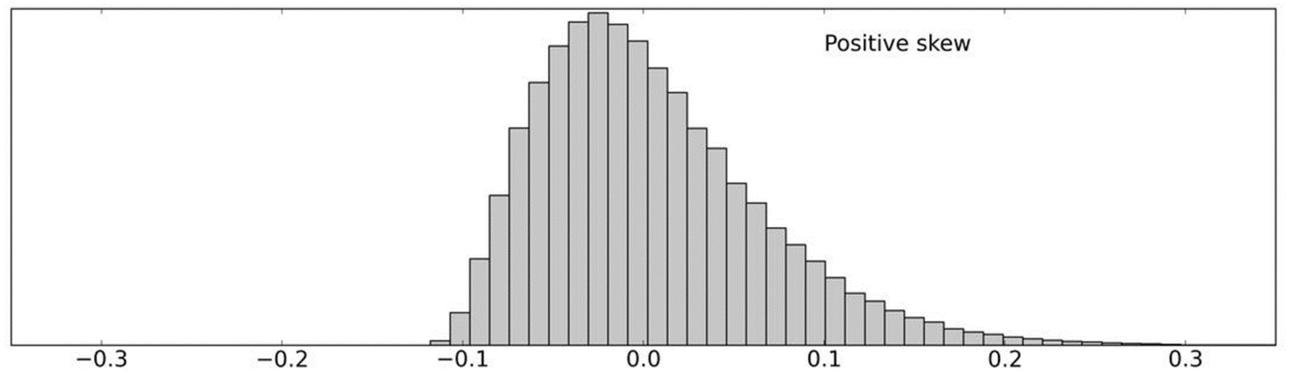

Divergent strategies

Divergent strategies, such as trend following or breakout strategies, assume that asset prices have moved away from an equilibrium price and would continue to do so as long as there is momentum.The returns of a divergent strategy follow a right-skewed distribution:

Return distribution of a divergent strategy (Y-axis: Frequency, X-axis: % return)

Profile of a divergent strategy

Low win rate (E.g. 40% of positions are profitable)

Avg. gain per trade > avg. loss per trade

TLDR: Fewer winning trades than losing trades, but average gains are higher

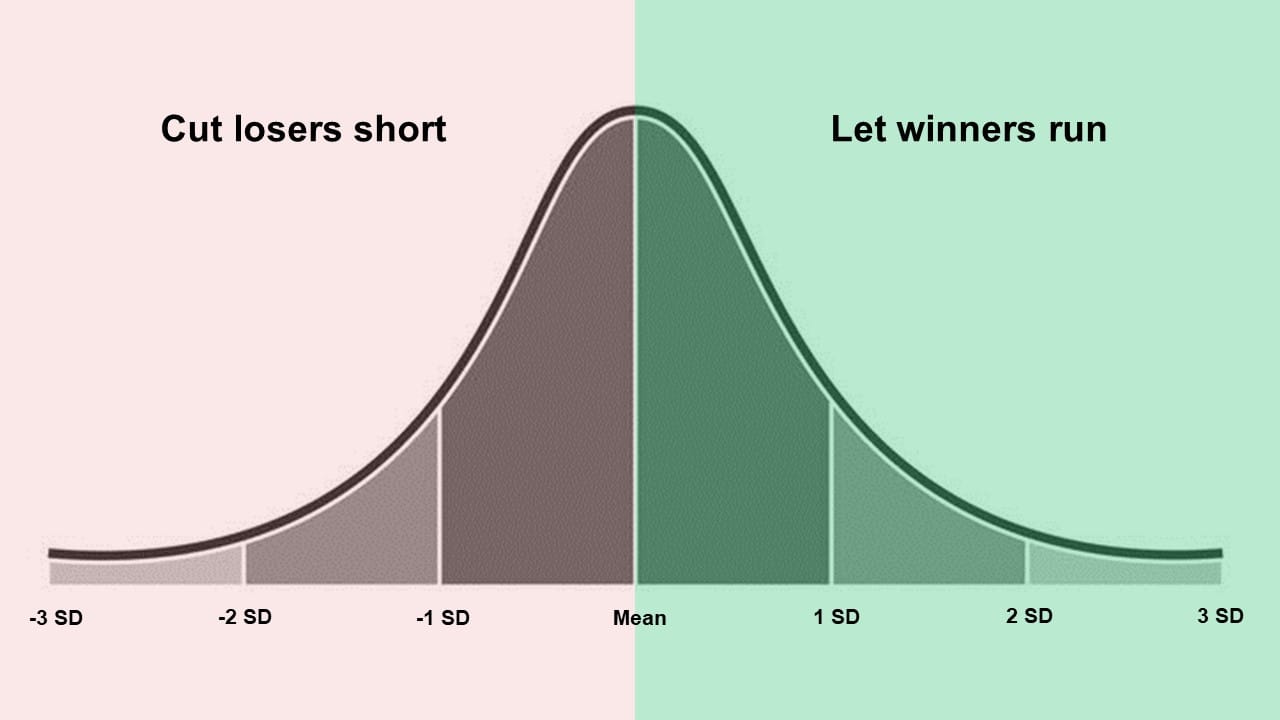

Systematic investing - The Tail Watching way

As Tail Watchers, our focus is on divergent strategies, where we capitalize on trending liquid markets to generate outsized returns. We don’t try to predict where prices would go. We simply follow where the trends lead us.

Investment philosophy of Tail Watching:

Don’t predict, just ride the trend for as long as you can | Cut your losers short, let your winners run | Diversify by asset class, industry & geography |

|---|

By building a diversified trend following portfolio, we allow alpha and fat tails to come to us, and let the power of compounding work its magic.

That is the Tail Watching way of systematic investing.

The art of sitting on your hands

“We don’t override the models.” – Jim Simons

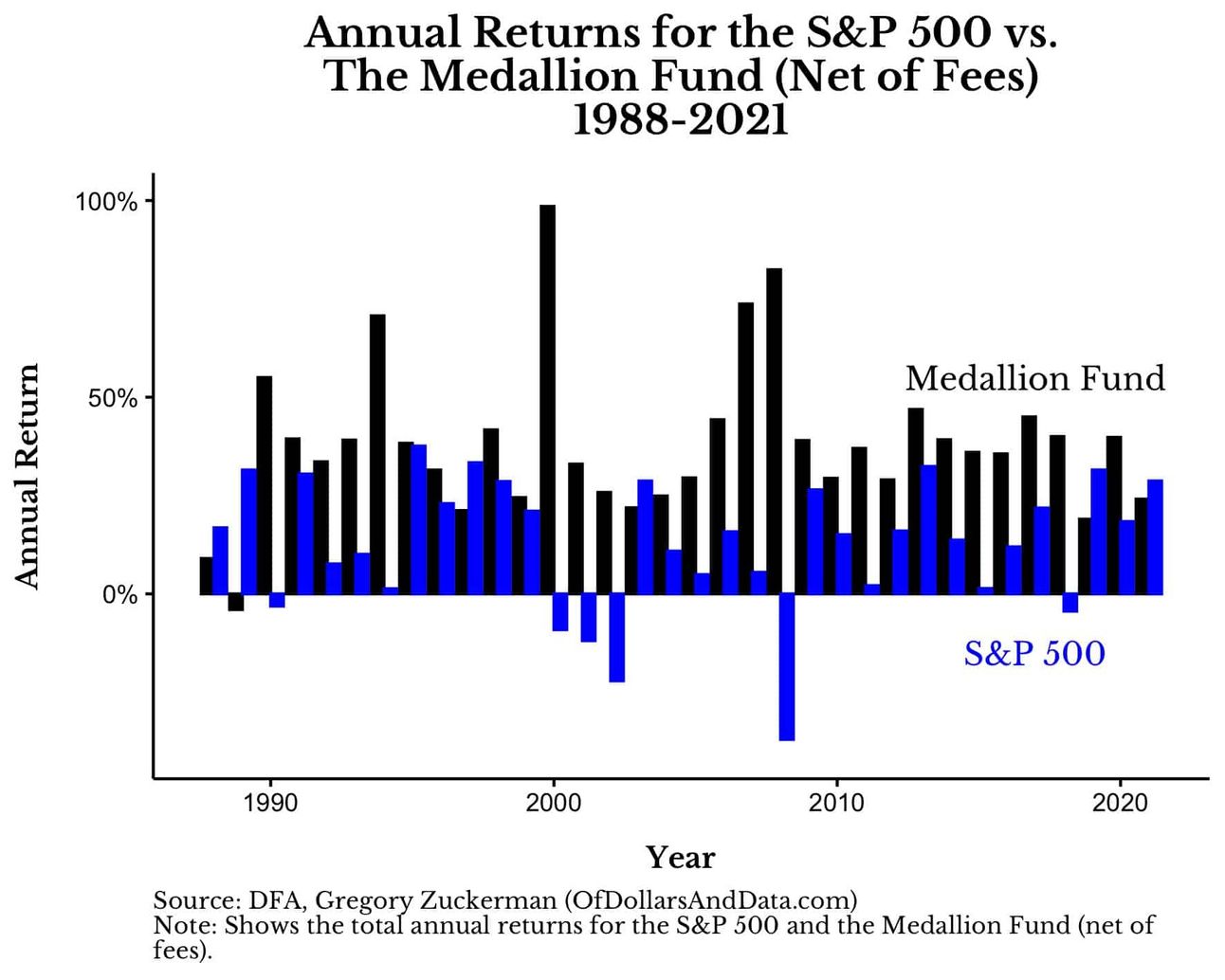

Jim Simons, the founder of Renaissance Technologies, built his $165 billion hedge fund based on the same systematic principles.

His approach has made his hedge fund one of the top performing candidates every year. Check out the performance of his flagship Medallion Fund over the years:

The toughest part about systematic investing is dealing with the urge to override the rules that you have predefined. In situations like this, the best thing to do is to sit on your hands and do absolutely nothing.

Remember: Rules are predefined and require no discretionary decision-making. Trust the system, and let the strategy run its course.

Like what Jim Simons said - RenTech does not override its models. Why should we?