In May, I did an analysis comparing the returns and drawdowns for dollar cost average (DCA) vs lump sum investing.

The numbers tell us that while on average, DCA yields lower returns than lump sum investing, DCA provides lower drawdowns.

A standard DCA model is well-suited for investors who like a straightforward approach to investing, in exchange for relatively lower volatility in their portfolios.

What if you wanted the same level of muted drawdowns with higher returns?

Keep reading!

The ‘normal’ way to DCA

Let’s do quick recap on the definition of DCA:

Dollar cost averaging (DCA): Investing your money over time. For example, splitting your money into equal tranches and putting them into an asset over a fixed time interval (E.g. Once every month)

By design, DCA is an effortless, almost mindless approach to investing.

Choose a day of the month, and purchase your stock or ETF on that day for every month.

The number of units to buy depends on the prevailing market price at the point of purchase.

Easy enough!

A better way to DCA

The biggest flaw of DCA lies in the fact that even when markets are bullish, you are adding to your position.

This does not allow you to optimize your average price.

The modified version of DCA requires you to add to your position only if the asset price is undervalued.

The big question is, when is a stock considered undervalued?

Firstly, we need to align on the definition of a stock’s fair value.

A simple way to measure this is using the stock’s 200-day simple moving average.

Simple moving average = (Sum of price for n periods) / n

We choose to use 200 days as our lookback period because it is often used to determine the long-term price trend.

Here’s an example of the 200-day simple moving average for Tesla (TSLA), represented by the red line:

200-day SMA for TSLA stock

If price > 200-day SMA, we assume the asset is overvalued.

If price < 200-day SMA, we assume the asset is undervalued.

The modified version of DCA (Timed DCA) only enters a DCA trade when price is below the 200-day SMA.

Here’s an example:

10 Jan: Buy TSLA stock

10 Feb: TSLA stock price < 200-day SMA. DCA into TSLA

10 Mar: TSLA stock price < 200-day SMA. DCA into TSLA

10 Apr: TSLA stock price > 200-day SMA. Do nothing

10 May: TSLA stock price > 200-day SMA. Do nothing

10 Jun: TSLA stock price < 200-day SMA. DCA into TSLA

As you can tell, the approach is almost exactly the same as a normal DCA, but with an additional condition.

How does the ‘Timed DCA’ fare against the ‘Normal DCA’?

I dug up my old analysis from May and used the same tickers to run a comparison between the two approaches.

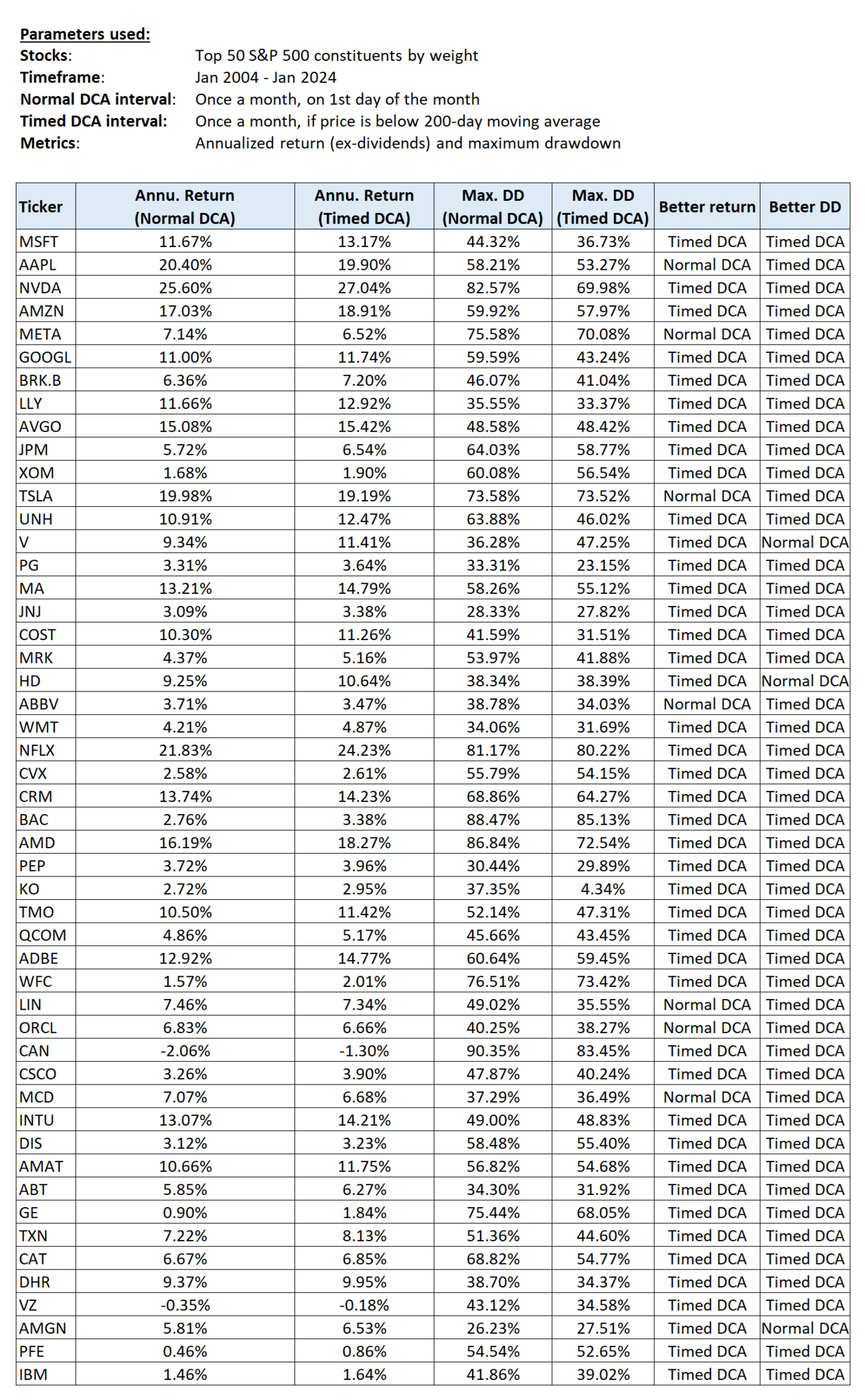

Here are the parameters used in this analysis:

Stocks: Top 50 S&P 500 constituents by weight

Timeframe: Jan 2004 - Jan 2024

Normal DCA interval: Once a month, on 1st day of the month

Timed DCA interval: Once a month, if price < 200-day moving average

Metrics: Annualized return (ex-dividends) and maximum drawdown

From this analysis, Timed DCA is the clear winner.

By how much of a margin, you ask?

Timed DCA yielded better returns for 86% of the sample

Timed DCA yielded better maximum drawdowns for 94% of the sample

Is Timed DCA for you?

The reality for most retail investors is that money comes in intervals, through salaries and bonuses.

With that in mind, any form of DCA is a good way to get started with investing for the general population.

If you have spare time each month to assess if price is below its fair value, yet you don’t want to spend too much time on complex investment strategies, then Timed DCA just might be for you.

That’s it for today!

Got questions? Feel free to drop me a note. I respond to every email.

I’ll see you soon!