Good old Goldman Sachs.

Famous for not just their involvement in the 1MDB scandal, but also their consistent trading profits.

You may be wondering - How good are they, exactly?

Fortunately, being a publicly traded company, it’s easy for us to dig out the numbers.

10-K results

As part of a legal requirement, Goldman Sachs files a 10-K report every year, shedding light on its operations across all of their business verticals.

You can find their report filings here.

Amidst these 100-pager reports, you’d find a section describing their trading desk activities, broken down into 4 categories:

Interest rates

Equity prices

Currency rates

Commodity prices

These 4 categories make up the high-level markets that Goldman Sachs is dealing in.

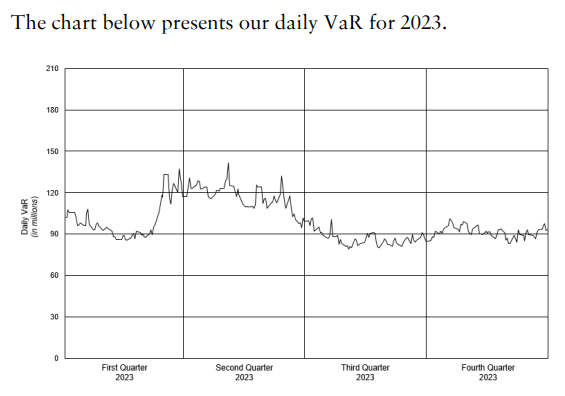

The images below show their Value At Risk (VAR) throughout the year, which measures the level of risk the trading desk undertook at any given point:

The distribution of daily net revenue from all of their positions in 2023 looks like this:

The first thing you’d notice is that they profit on any given day at a significantly higher rate than they lose. In addition, the size of their profits is much larger on average, compared to the size of their losses.

Sounds familiar?

If it does, it’s because the return distribution follows a typical divergent strategy profile. You can read more about divergent vs convergent strategies in this post.

Since the trading results demonstrate a highly favorable risk-to-reward ratio - This has to mean that Goldman Sachs adopts a low win rate strategy right?

Here comes the kicker

Instead of having a < 50% win rate as one would expect of a divergent return distribution, Goldman Sachs profits 85% of the time!

This means that they only have a losing day approximately 15% of the time. During these loss-making days, their average loss is between $0 to $25mil.

On the flipside, their average profit is almost $75mil.

This deviates from what we know about typical divergent strategies.

Clearly, Goldman Sachs utilizes a combination of both divergent and convergent trading methods to achieve a high win rate with larger average win sizes than losses.

What can we learn from this?

Goldman Sachs is a great example of how well traders can do in the markets when they have proven edges and strategies.

Apart from showing us how fat their wallets are, the 10-k filings by Goldman Sachs also highlight the fact that it is not only possible, but probable for market participants to profit from the markets.

Many other large firms consistently produce similar profitable results.

With the right edges and tools, retail investors can also replicate similar return distributions by utilizing enduring, market-tested strategies.

A good example would be trend following. Trend following is one of the best strategies any retail investor can adopt. You can learn more about it here.

Apart from that, there are plenty of other probability-based strategies that retail traders could arm themselves with. In time to come, I would provide more examples and case studies of how retail traders and investors can adopt proven strategies to profit from the market, regardless of your investment horizon.

Stay tuned!

That’s it for today!

Got questions? Feel free to drop me a note. I respond to every email.

I’ll see you soon!