Over the weekend on 10 May 2024, Jim Simons, a mathematician who founded the most successful quantitative hedge fund of all time, passed away in New York City. May he rest in peace.

Jim was a huge inspiration to me.

His approach to quantitative trading and investing has shaped the way I run Silverhat Capital and Tail Watching.

His principles and methods have also paved the way for quants and systematic hedge funds all across the globe.

In today’s newsletter, I would break down the key insights from Jim Simons that we could apply as retail investors.

Who is Jim Simons?

Born in 1938, Jim Simons was often referred to as the GOAT of the hedge fund industry. Jim was the founder of Renaissance Technologies, a quantitative and systematic hedge fund that reaped annual returns of 66% since 1988. Jim’s approach to the markets was fully systematic and many attribute the quant revolution of Wall Street to him.

Jim was a mathematician and arguably had a full career before leaving to start Renaissance Technologies. He studied mathematics at Massachusetts Institute of Technology (MIT) and later got his Ph.D. from the University of California, Berkeley.

Jim was a codebreaker during his time with the National Security Agency (NSA). He helped to decipher codes during the Cold war while simultaneously teaching at MIT and later at Harvard University.

Before Jim shifted his focus to finance in the late 1970s, he had formally received recognition in mathematics, geometry and topology.

Renaissance Technologies

In 1978, Jim Simons started his first hedge fund Monemetrics. The fund was moderately successful and employed both fundamental and technical approaches to the markets, but Jim felt “gut wrenched” by the emotional swings from discretionary trading.

In 1982, he decided to employ a purely systematic approach, and started his new fund, Renaissance Technologies, which relied on a team of mathematicians, computer scientists and physicists to pioneer a new approach to algorithmic trading.

Because of the success of Renaissance Technologies, Jim Simons has been described as the “best money manager on earth”.

The Medallion Fund

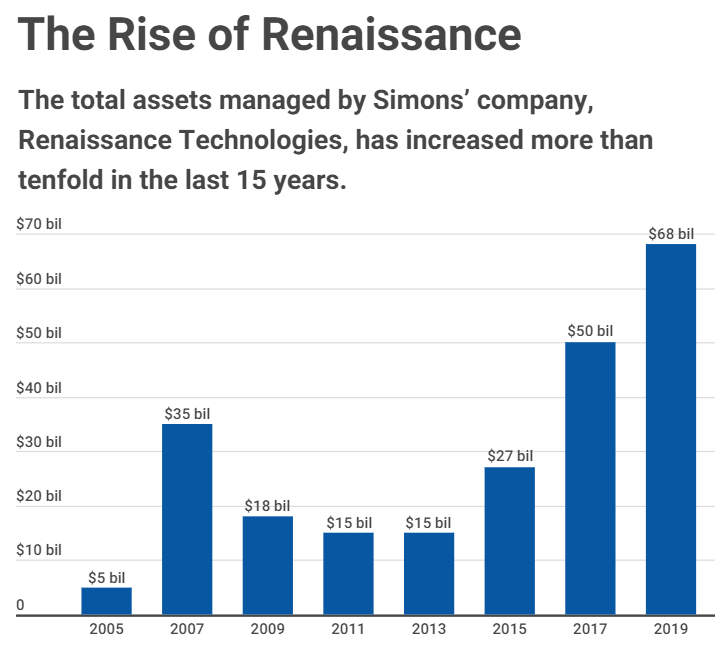

Renaissance Technologies’ flagship Medallion Fund reaped annual returns of 66% between 1988 to 2018, and rose its assets under management by more than tenfold in the last 15 years.

Here are the key attributes of the Medallion Fund:

Fully systematic and rule-based

Diversified across timeframes and asset classes

Data-driven

Compounding creates wealth

What can we learn from Jim’s approach?

Jim Simons’ systematic approach to investing taught me more than any business school ever could. Even after investing systematically for 10 years, I uncover new insights every time I revisit his firm's principles.

Here are my key insights:

Insight 1: An edge is important, not why it exists

Jim Simons believed that if a predictor has edge and is statistically significant, it is less important to explain the hypothesis. Data mining for alpha works, as long as the inherent biases are carefully avoided.

Discarding an edge because we cannot explain it could be a mistake, and one should remove human bias and let the data point you to where, when and how to trade.

Insight 2: Trust your model, and stick to it

Jim Simons emphasized the importance of treating trading like a business that can be modelled, backtested and followed.

He believed that you cannot run a trading business that relies on your emotional state or gut instincts.

Being 100% systematic means believing in your trading model and not manually intervening in your trading systems when they are live. Data and statistical evidence provide you with the winning formula, not gut feelings.

Insight 3: Edge does not have to be big

A diversified portfolio of strategies, each with a small edge could generate astronomical returns. Seeking the perfect entry or exit with just one strategy is often a poor approach.

Much more can be gained by combining unique, micro edges across a broad breadth of investment vehicles.

Insight 4: Win rate is only part of the equation

Jim Simons said that “Success in investing is not about being right all the time. It’s about minimizing losses and maximizing gains.”

This can be achieved by adopting strategies that combine return streams with both left-tailed and right-tailed distributions. This allows you to tap on convergent and divergent types of strategies, like we discussed in this article.

A low win rate strategy with a higher reward-to-risk ratio and be profitable as much as a high win rate strategy with a less favorable reward-to-risk ratio. That’s the beauty of systematic investing!

Beyond the Medallion: The enduring legacy of Jim Simons

Jim Simons may have left us, but his data-driven approach would continue to shape the world of quantitative investing. Thanks to Jim, people like me are inspired to delve deeper into the intersection of mathematics, computer science, and finance.

His success with Renaissance Technologies has shown the immense potential of quantitative analysis, and his pioneering spirit had opened doors for a new generation of quants to push the boundaries of what's possible.

Jim’s legacy is a testament to the power of human ingenuity, and his influence will undoubtedly continue to guide the evolution of quantitative investing for years to come.

That’s it for today!

Got questions? Feel free to drop me a note. I respond to every email.

I’ll see you soon!