The million dollar question in investing: When do I take profit?

It’s tough enough picking quality assets to invest in. Finding the ideal price to take profit? Geez! How does one achieve that?

If you feel overwhelmed and are suffering from decision paralysis, trust me - You are not alone. It’s never easy finding a good price to exit your investments, but there is an approach that can make your life easier: Trailing stops.

What is a trailing stop?

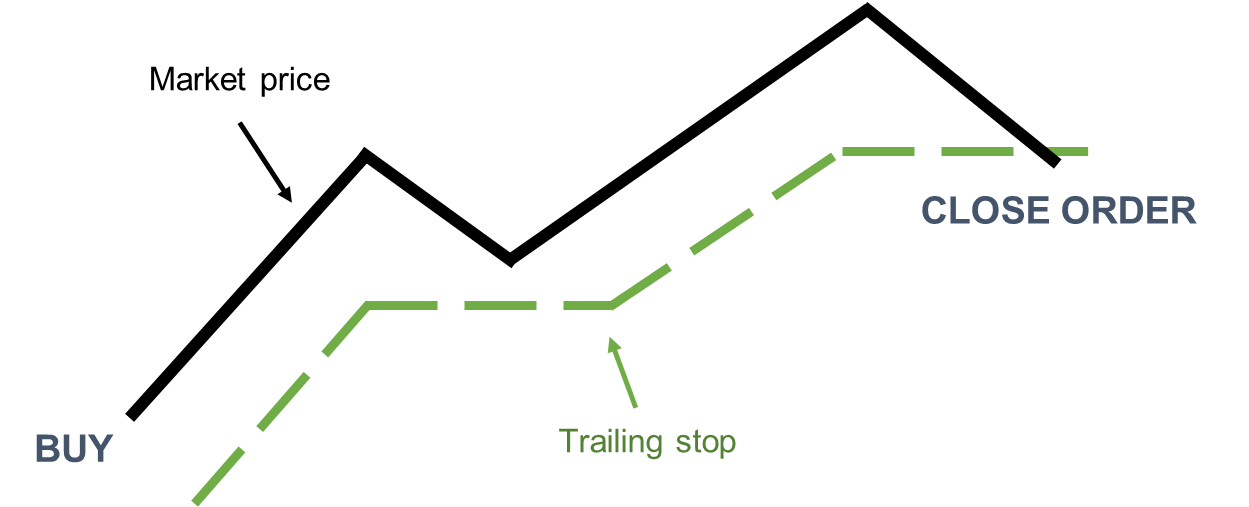

Unlike a traditional stop-loss order that sets a fixed price to exit a position, a trailing stop is a dynamic order that automatically adjusts as the market moves in your favor.

Here’s how it works:

For long positions, where you expect price to increase, you place a trailing stop below the current market price.

As price moves favorably, the trailing stop adjusts itself by a predetermined percentage or dollar amount, essentially “trailing” behind the price. This helps you lock in profits if the price starts to reverse.

As you can tell, if the trailing stop is too close to the market price, you aren’t allowing enough buffer for price movements. Conversely, if you place the trailing stop too far away from the market price, you are giving up potential returns.

To find the right distance to place your trailing stop, you could consider the following:

Use a dynamic reference point instead of a fixed percentage or distance (Such as a moving average)

Use average price volatility as a determinant (Such as the average daily range)

Why use a trailing stop?

Trailing stops are a valuable tool for managing risk and locking in profits. It provides a systematic way for you to cash in on your investments, allowing you to adopt a disciplined approach to exiting your positions.

More importantly, it takes away the need for you to constantly second-guess when is the best time to close your profitable positions.

Trailing stops are also a good tool for systematic trend followers, as they can be effective in trending markets where price moves in a sustained direction.

Tips on using a trailing stop

Before deploying any trailing stop strategy with real capital, it’s important to test it thoroughly using historical data. This allows you to see how the strategy performs in different market conditions and fine-tine your parameters before risking real money.

Experiment, backtest and constantly evaluate your results to find what works best for you.

I use trailing stops extensively in my own systematic investments, and I love how they have made my life so much easier. If you don’t already use them, I’d highly recommend starting now.

If you want to learn more about the basics of systematic investing, give this article a read.

That’s it for today!

Got questions? Feel free to drop me a note. I respond to every email.

I’ll see you soon!